Are you one of the many people who are anxious to get their tax refund? If so, you’re in luck! In this blog post, we will discuss some tips that will help speed up the process. The sooner you file your return, the sooner you will receive your refund. Follow these tips and you’ll be enjoying your money before you know it!

1. Check the status of your refund on the IRS website

Use the Where’s My Refund tool to check your refund status. You can find out if it has been processed, approved and mailed to you. This is a great way to see where things stand at any given time during tax season! If there are any issues with your return that need attention from an IRS agent, they will contact you by mail.

This is the first thing you should do when you’re ready to start tracking your refund. Checking the website regularly will help keep you updated on where your return is in the process.

Tip: Make sure that you have the correct mailing address on your tax return so that your refund can be sent to the correct location!

Also be sure to include your Social Security Number or Individual Taxpayer Identification Number (ITIN) so that we know who it belongs to. If these two things are incorrect, there might be delays in processing your return. You can check the status of your tax refund online here.

2. File your taxes electronically – this will speed up the process

When you file electronically, your return is sent directly to the IRS. This means that there are fewer chances for errors and it will be processed more quickly. The best part? You can e-file from home!

There are many different ways to file your taxes electronically – through an online tax preparation service, or even through your bank. Check with your bank to see if they offer this service.

Tip: If you’re using a tax preparer, ask them if they offer electronic filing. This is the best way to ensure that your return is processed quickly!

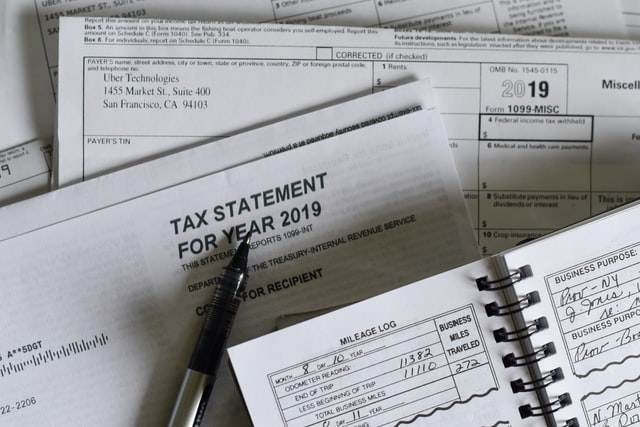

3. Make sure you have all your W-2s, 1099s, and other tax documents ready

One of the main reasons why tax refunds take so long to process is because of missing documents. When you file your return, the IRS will be looking for specific information like W-24s and Social Security Numbers. If they don’t have everything they need, they’ll have to send out a request for more information – which will only delay the process further.

That’s why it’s important to make sure you have all your tax documents ready when you file your return. This will help ensure that there are no delays in processing your return. And if you’re missing any documents, don’t worry! You can still file your return and send in the documents later on. The IRS will send you a notice with instructions on what to do next.

Tip: Make sure your employer has given you all necessary tax documents by February 15th or earlier if possible. This will ensure that there are no delays when it comes time for filing!

If they haven’t, call them and ask about it so that everything is ready before April 15th.

4. Choose direct deposit for your refund – this is the fastest option

When you choose direct deposit for your refund, the money goes directly into your bank account. This is the fastest way to get your money and it’s more secure than getting a check in the mail.

Plus, you can usually have your refund deposited into up to three different accounts – making it easy to spread out the money!

Tip: If you want to set up direct deposit, talk with your bank about how they can help. They might offer this service for free or at a discounted rate!

It’s also important not to wait until the last minute because once it’s done, there won’t be any changes made after that date has passed (the IRS will only mail you a paper check if you haven’t set up direct deposit).

5. If you owe money to the IRS, file Form 1040V to pay by credit card or debit card

If you owe money to the IRS, you can pay by credit card or debit card. You can do this by filing Form 1050V – which is a payment form that allows you to pay your taxes with a credit or debit card.

This is a convenient way to pay your taxes and it’s more secure than sending cash or a check. Plus, you can track your payments online.

Tip: You can also pay your taxes with a credit card by using the IRS’ Online Payment System. This is a safe and easy way to make your payment!

6. Review your return for mistakes before submitting it

This is probably the most important tip of all! When you’re filing your return, make sure to review it for mistakes. This will help ensure that there are no delays in processing your return.

If you find any mistakes, fix them and resubmit your return. The IRS might send you a letter asking for more information – but it’s better than having them deny your entire return!

Tip: If you’re using any kind of tax software, make sure to check the “Review” tab before submitting your return. This will allow you to review all information and make changes if necessary.

If you choose not too and submit without reviewing first, then there could be errors in your return which will cause delays when processing time comes around.

The IRS has made it easier than ever to get your tax refund faster. Follow these steps and you should be able to cut the time between when you mail in your return and when you receive your money back by at least a few weeks. Stay tuned for more updates on how to speed up that process even further!

Leave a Reply