There is a lot of discussion these days about the possibility of raising taxes in order to improve the economy. But what does that mean for businesses and consumers? And more importantly, what does it mean for the economy as a whole? In this blog post, we will take a look at the effect of raising taxes on the economy. We will discuss how it can impact businesses and consumers, and we will also explore the possible consequences of such a move.

1. The definition of a tax and what it is used for

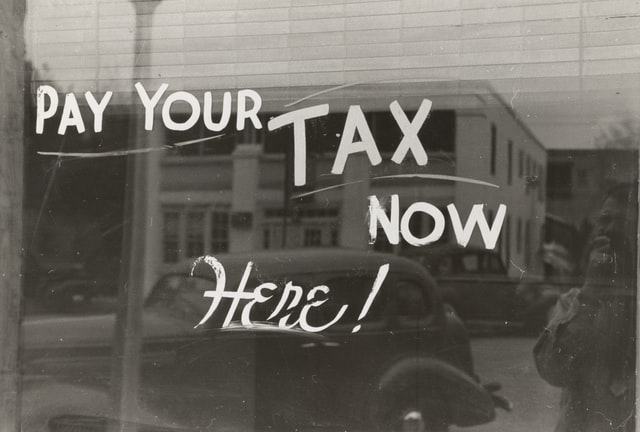

Taxes are important because they help to fund the government and pay for programs that benefit all citizens, such as social security, Medicare, education, and infrastructure. Taxes also help to reduce income inequality by providing funds for social welfare programs.

However, taxes also have negative effects on the economy. For example, businesses may be less likely to invest in new products or expand their operations if they know that taxes will be going up. This can lead to a decrease in economic growth and fewer jobs being created. Consumers may also be less likely to spend money if they know that taxes are going up, which can lead to a decrease in economic activity.

2. How taxes are raised and the different types of taxes

Raising taxes is a part of government policy and is used to help fund the federal budget. It can be done by increasing the amount of money that people pay per year or decreasing it. The first type of tax increase is called an income tax, which means you will have to pay more money based on how much you make each year. The second type of tax increase is called a sales tax (Value Added Tax), which means you will have to pay more money based on what you buy each year.

When taxes are raised, more people pay them. This can lead to an increase in consumer prices because businesses have less money left over after paying their employees and providing goods or services for sale. As a result, consumers may decide not to buy certain items due to the higher cost of living; this could then lead to unemployment rates rising again a fews months after the tax increase.

There are also other ways to raise taxes, such as by increasing the amount of money that people have to pay on their property or by taxing goods and services that are used by businesses.

The government can also lower taxes in order to stimulate economic growth. This is done by giving people more money to spend, which can then lead to an increase in consumer spending and economic growth.

The most common taxes are:

- Income: based on how much you earn each year. This can be progressive (higher rates for higher incomes) or regressive (lower rates for lower incomes). Income tax is generally levied on individuals, but some states impose taxes at the corporate level as well.

- Sales: based on what people buy each year. Value-added taxes are usually imposed by states and local governments.

- property: based on the value of your home, land or other real estate holdings. Property taxes can be levied at different levels (local, state, federal), but they’re all based on some form of property ownership. The most common type is ad valorem tax which means “according to value.”

- Investment: based on what you invest in, it can be either an income or capital gain.

- Corporate: taxes levied at the corporate level, they may include a variety of different types such as business profits tax and dividend withholding tax.

- Inheritance: based on the value of what someone inherits when they die, it can be either an income or capital gain. Inheritance taxes are levied on estates that are worth more than $11 million per person or $22 million per couple in 2018; this figure will increase each year until 2025 when it reaches unlimited levels again after which point tax rates will be set at 55%.

3. The effect of raising taxes on the economy

When taxes are raised, they will increase the price of goods and services. This may lead to a decrease in economic activity as people have less money left over after paying their taxes.

The government can also lower taxes, which means that consumers have more money to spend or save for later use (e.g., retirement). Lowering income tax rates can also encourage businesses to invest in new products or expand their operations. This could lead to an increase in economic growth and creation of jobs.

4. Ways to reduce the negative impact of tax hikes on consumer spending

There are a few ways to reduce the negative impact of tax hikes on consumer spending. For example, businesses could absorb some or all of the increase in order to maintain their market share and profitability. The government could also provide rebates or other forms of financial assistance to help people pay for the increased cost of living.

Tax holidays are another way to reduce the negative impact of tax hikes on consumer spending. Tax holiday is a period when no taxes are imposed and consumers have more money available for purchases; this could lead to an increase in economic activity as well as employment rates if enough people take advantage of them!

5. The importance of being financially responsible

It is important for everyone to be financially responsible. This means that you should save money for emergencies, invest in your future and avoid taking on too much debt.

It is important for everyone to be aware of the effect that tax hikes can have on their personal finances so that they can plan accordingly. For example, if you know how much your taxes will increase by next year then it’s easier to prepare for it now rather than waiting until after the fact and having no time left over at all!

If you are planning on making any large purchases or investments in near future, consider doing so before tax rates go up. This will help you save money in the long run!

Although it is still uncertain what will happen with the economy when taxes are raised, we can hope that things will go well. There are many factors to consider when it comes to the effect of raising taxes on the economy, and only time will tell what happens. Stay tuned for more updates and tips from us here at The Finance Hacker.

Leave a Reply