When you are looking for a safe and reliable investment option, zero coupon bonds may be the answer. These bonds offer investors stability and predictability, which can be important when you are planning for your financial future. In this blog post, we will discuss how to use zero coupon bonds for your investments. We will cover everything from how they work to the benefits they offer. So, if you are thinking about adding zero coupon bonds to your portfolio, read on!

1. What are zero coupon bonds and how do they work?

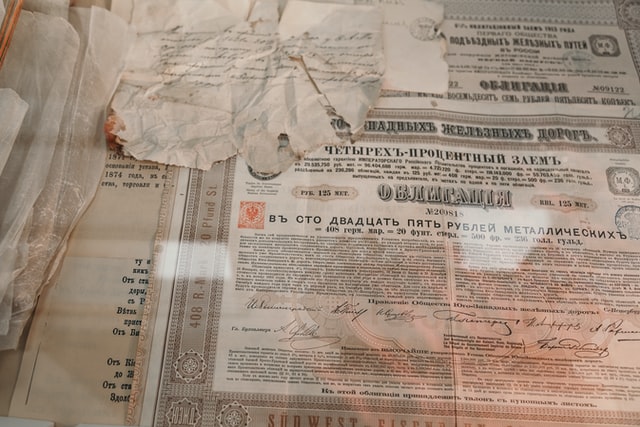

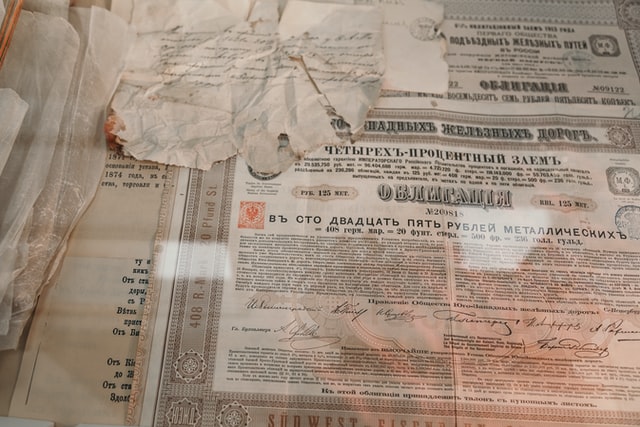

Zero coupon bonds are debt securities that do not pay periodic interest payments like other types of bonds. Instead, these bonds are purchased at a discount to their face value, and the investor receives the full face value at maturity. This is why they are also known as “discount” or “stripped” bonds.

Zero coupon bonds are often issued with maturities of at least ten years, but some may be as long as twenty or even thirty years. These bonds can also be traded on the secondary market before they mature, allowing investors to realize gains or losses depending on their performance over time. Because zero coupon bonds do not pay interest until maturity date, they are considered to be higher risk than other types of bonds.

2. Why use zero coupon bonds in your investment portfolio?

There are a number of reasons why zero coupon bonds may be a good addition to your investment portfolio. Here are some of the key benefits they offer:

– Stability and predictability: As we mentioned earlier, one of the main benefits of zero coupon bonds is their stability and predictability. Because these bonds pay no interest until maturity, you can be sure that your principal investment will be repaid in full. This can be important for investors who are looking for a reliable way to save for the future.

– Tax efficiency: Another benefit of zero coupon bonds is their tax efficiency. Since these bonds pay no interest until maturity, they do not generate taxable income as long as they are held in a taxable account. Even after an investor sells the bond, only 50% of the gain is taxed as ordinary income and not at capital gains rates.

– High yield: If you are looking for investments that offer high yields, zero coupon bonds may be a good choice because they typically have higher interest rates than other types of debt securities such as corporate bonds or Treasury securities.

– Flexibility: One of the most appealing aspects about zero coupon bonds is their flexibility. You can choose from a variety of different maturities and interest rates to meet your investment goals while still maintaining liquidity in case you need access to cash before maturity date (for example, if an emergency arises).

3. How to buy zero coupon bonds

There are many different ways you can purchase zero coupon bonds, including through a broker or financial advisor. If you do not have access to these types of professionals, there are other options available as well:

– You could buy them directly from the issuer using their website or phone number listed on the bond’s prospectus (which provides information about how the bond works, risks, and other important details).

– You could also buy them through a secondary market such as the New York Stock Exchange or Nasdaq.

Once you have decided on the particular bond you want to purchase, you will need to decide how much money you want to invest. Keep in mind that most zero coupon bonds are sold in denominations of $1,000 or more, so you may need to save up before you can buy.

Once you have purchased your zero coupon bond, it is important to keep track of its performance. You can do this by checking news sources and financial websites for updates on the bond’s price. This information will help you decide whether to hold the bond until maturity or sell it before then (based on whether you think the price will go up or down). If necessary, talk with a financial advisor about any questions that arise from time to time so they can provide advice specific to your situation.

4. Tips for investing in zero coupon bonds

When investing in zero coupon bonds, it is important to understand how they work and what risks are involved. Here are some tips that may help you as an investor:

– Do your research before buying any type of bond – make sure that you know the issuer well enough so if something happens with them (e.g., bankruptcy), then you won’t lose all your money.

– Look at the bond’s rating, which indicates its creditworthiness (i.e., whether or not it will be able to pay back what you’ve invested). Make sure this matches up with your risk tolerance level before making a purchase decision about bonds!

– If possible, invest in different types of zero coupon bonds so that you’re not too reliant on one issuer or investment. This will help to spread out the risk and protect your portfolio in case something happens.

– Keep an eye on the market and be prepared to sell if the price goes down (or buy if it goes up). Remember, you don’t have to hold a zero coupon bond until maturity!

Investing in zero coupon bonds is a great way for investors who want their money now but don’t want the risk of investing in stocks or other volatile assets like mutual funds. These instruments provide a stable income stream with no taxes due until maturity date (at which point only half the gain will be taxed as ordinary income and not at capital gains rates).

That’s all for now! Be sure to come back for more updates and tips on how you can use zero coupon bonds in your own investment portfolio. In the meantime, feel free to reach out if you have any questions – we would be happy to help!

Leave a Reply